Basic personal finance is an essential skill that isn’t generally taught in schools. Hopefully your parents or older siblings were willing to take the time and show you the basics of bank accounts, taxes, and credit cards. Here are some less-obvious things about personal finance that are incredibly important, whether you make $15,000 a year or $150,000.

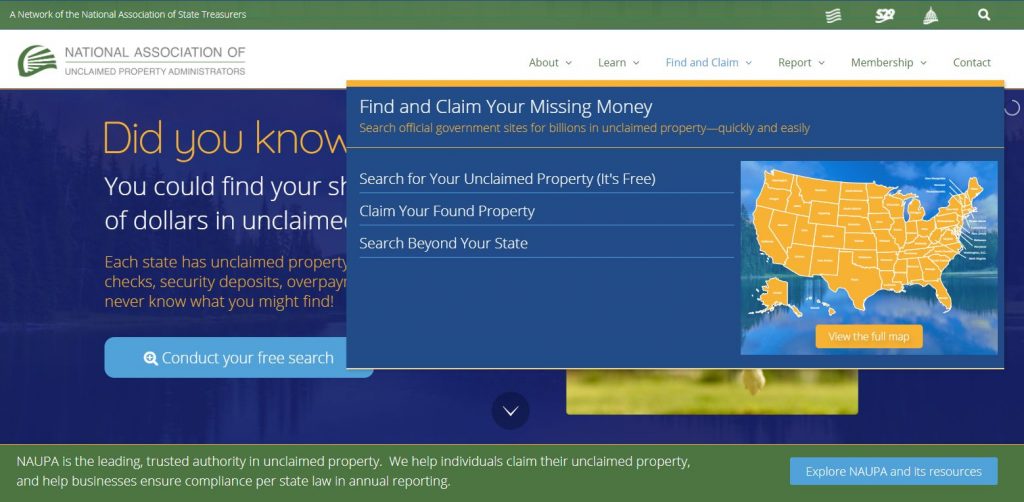

Reclaim What’s Yours

You might have money or belongings hiding in a state treasury somewhere. Every state in the US has a database of unclaimed property. Maybe you left a last paycheck at a job you quit. Maybe you over payed a parking ticket or a tax and are due a refund. You can check these databases for free online at https://unclaimed.org/. You’ll need to print out a form to mail in along with proof of identity and updated contact information. Make sure you check the database for every state that you’ve lived in!

Optimize Your Accounts

First you want to get your basic accounts in order. No one should be paying a monthly service fee for a checking or savings account anymore. If you are paying one, ask your bank how to avoid it, usually by getting your paycheck direct deposited, or by maintaining a certain daily balance. If your bank has no free options, then its time to switch banks! Discover and Capital One have awesome free checking and savings options, and both pay well above the national average interest rates on their savings accounts. Next up is reaching out to your credit cards. Call customer service and make sure you’re taking advantage of any promotional interest rates that are currently being offered.

Also, If you’ve recently had a late fee or overdraft fee on your account, ask to have it removed! There’s a special Customer Retention department in most business that can and usually will remove these fees if you tell them to. You should always be polite, and remind them of how long you’ve been a customer. Be firm, and be willing to stay on the line until they reverse the charge. Remember, personal finance is about people too, and customer service agents are just as aware at the absurdity of bank fees as you are.

Automate Your Finances

As humans, we are fallible. Being honest with myself, I tend to be lazy and forgetful. In order to protect myself from myself, I automate my personal finances in every possible way. This begins with my paycheck coming in. Ask your employer if they offer direct deposit, so that way you won’t have to worry about getting to the bank every time. I also set every bill I possibly can to pay automatically every month. Set your cell phone, car insurance, water bill and electric bill to get charged to your credit card. Also, make sure your credit card minimum payment, rent and car payment get taken out of your checking account every month too. Then take it to the next level and automate your personal savings goals!

Reduce Your Recurring Bills

You hear commercials all the time about saving money by switching car insurance companies. But when was the last time you price shopped your insurer? Or your cell phone plan? Saving money on these types of bills is a huge benefit because you do it once and keep saving every month.

Car insurance can be a pain to shop for, so consider calling an insurance broker. A broker works with several different insurers and will get you quotes from all of them with one phone call. A good trick to try is also combining renter’s insurance. In addition to being a great way to protect your belongings, adding renter’s insurance can make you eligible for multi-policy discounts that you wouldn’t otherwise get, and sometimes even ends up being free!

Discount cell phone plans are not the crappy replacements they used to be. All of the discount providers are using the same exact networks as the expensive carriers. There are a ton of options available, but generally if you’re paying more than $45/month per line of unlimited data you can switch and rack up the savings.

Secure Your Accounts

You’ve read in the news about how identity theft is getting more and more advanced every year. You’ve probably also heard about data breaches at big companies becoming more common. At the end of the day, you have a lot of control over how these trends affect your finances.

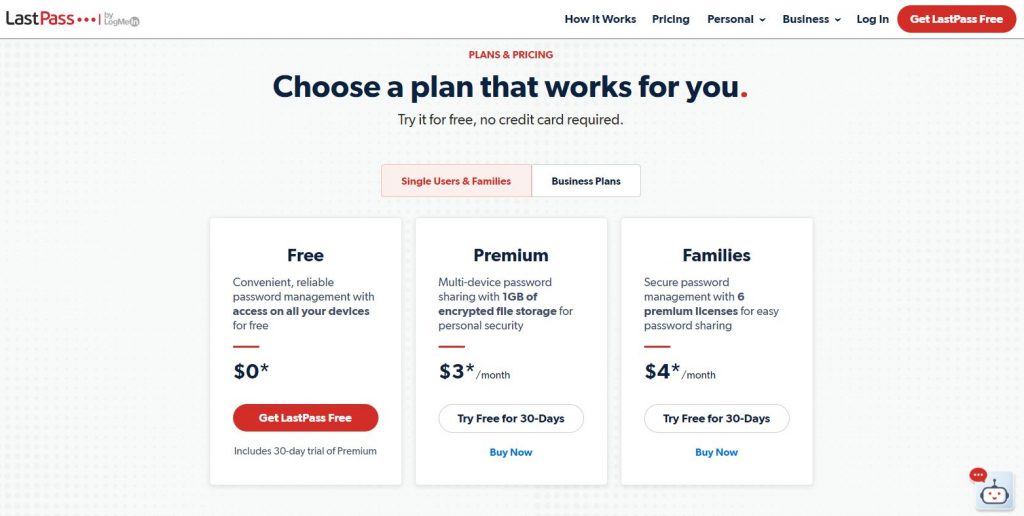

Start simply by making sure your passwords are recent and unique. I use a simple browser plugin called LastPass to generate secure and unique passwords for every site I visit. LastPass has a very full featured free version, and incredibly reasonable pricing for their premium tier.

I also highly recommend using Two Factor Authentication (2FA) on your more sensitive accounts. The most basic form of 2FA is those 4-6 digit codes that get texted to you before logging in to a site. You should consider using a stronger 2FA like Authy, Microsoft Authenticator or Google Authenticator wherever they are offered.

Start Saving for Retirement Early

Americans have a serious shortfall of retirement savings, and the best remedy is to get started early. Even if you are on the tightest of budgets you’ll benefit from setting up your retirement accounts. The easiest time to start a retirement account is right when you get your tax return. You can open an IRA (Individual Retirement Account) though Betterment with just a $10 initial deposit, while my personal broker Wealthfront starts with a minimum $500 deposit.

There are several reasons its hugely valuable to start an IRA early. First, there is an annual maximum of $6,000 that you can deposit. You have until April 15th of the following year to make contributions, but once a year passes there’s no way to go back. Second, IRAs can be passed down to a beneficiary after you die and pass along all of the tax benefits that come with it. Third, IRA’s are protected from creditors, therefore even if you file for bankruptcy, no one can touch the money that’s inside!

Focus on Your Health

Why are you talking about health? I thought this was a personal finance site! Did you know Americans spend a total of $1.5 trillion per year on treating preventable chronic diseases? These are the diseases that result primarily from smoking and obesity. Prevention is always easier than treatment, and there are easy and free things that you can do to help reduce your risks.

It will always be more expensive to deal with health issues later. Consider that getting a cavity filled at a dentist can easily be $100 or more. But remember that getting a root canal if the problem gets worse will cost you up to $1,000 or $1,500!

Living Will and Trust

Over 90% of Americans have no plan if something were to happen. This means not only no financial plan, but also no plan for important medical decisions. Having a living will and trust establishes two things: 1) Who is in charge of making medical decisions in case you are unable to and 2) What happens to your accounts, real estate, and belongings after you die. Setting up a living will and trust is easy through an app called NetLaw. For a flat fee of $600 you can not only set up the documents, but you can consult for free with lawyers through their live chat. The documents you create are stored in their secure vault forever, and you can update them as you move through life events.